What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is a critical metric for businesses, especially in the SaaS industry. It represents the total revenue a business can reasonably expect from a single customer account throughout the entire duration of their relationship. Essentially, CLV helps companies understand the long-term value of their customers, providing insights into how much they should invest in acquiring and retaining them.

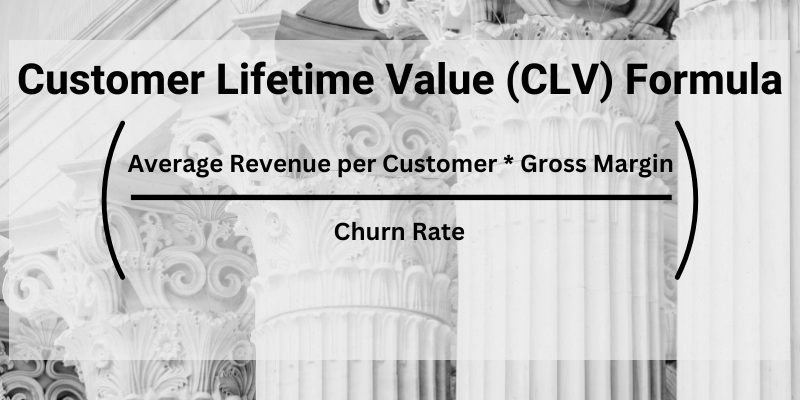

How to Calculate Customer Lifetime Value (CLV)?

Calculating CLV may sound complex, but it’s straightforward once you break it down. Here’s a formula to guide you:

Let’s break down each component:

- Average Revenue per Customer: This is the total revenue generated from a customer, typically measured annually. For instance, if your average customer brings in $48,000 per year, that’s your average revenue.

- Gross Margin: This is the percentage of revenue that exceeds the cost of goods sold (COGS). For example, if your gross margin is 80%, it means you’re retaining 80% of your revenue after covering the COGS.

- Churn Rate: This represents the percentage of customers who stop using your service over a specific period. A churn rate of 5% indicates that 5% of your customers leave each year.

Using these figures, let’s calculate the CLV:

CLV = ($48,000 * 80%) / 5% = $768,000

This means each customer is worth $768,000 to your business over their lifetime.

The Relationship Between CLV and Other Key SaaS KPIs

Customer Acquisition Cost (CAC)

One of the most crucial aspects of understanding CLV is its relationship with Customer Acquisition Cost (CAC). CAC measures how much a company spends to acquire a new customer. For a business to be profitable, its CAC must be lower than its CLV. If it costs more to acquire a customer than the revenue they generate over their lifetime, the business model is unsustainable.

For example, if your CAC is $50,000 and your CLV is $768,000, you’re in a healthy range. However, if your CAC approaches or exceeds your CLV, it’s a red flag that indicates a need to reassess your acquisition strategy.

Average Revenue per Customer (ARPC)

Average Revenue per Customer is another essential metric tied to CLV. It provides insights into how much revenue each customer contributes on average, which directly impacts the CLV calculation. By increasing your ARPC, you can significantly boost your CLV.

Gross Margin

Gross Margin is crucial because it reflects the profitability of each customer. Higher gross margins contribute to higher CLVs, making it vital to manage costs effectively while maximizing revenue.

Churn Rate

Churn rate is inversely proportional to CLV. A higher churn rate reduces the CLV, making it imperative to focus on customer retention strategies. Reducing churn by even a small percentage can have a substantial positive impact on your CLV.

Real-World Application and Importance of CLV

Understanding CLV enables businesses to make informed strategic decisions. For instance, if a SaaS company knows its CLV is $768,000, it can confidently invest up to that amount (preferably less) in customer acquisition and retention activities without the risk of overspending.

Case Study

Consider a SaaS company specializing in enterprise software solutions. Their average revenue per customer is $48,000 annually, with a gross margin of 80% and a churn rate of 5%. By calculating their CLV, they determine that each customer is worth $768,000 over their lifetime.

With this knowledge, they set a CAC threshold of $50,000, ensuring they maintain a healthy profit margin. This allows them to allocate sufficient resources to marketing and sales initiatives while keeping an eye on profitability.

Furthermore, by focusing on reducing churn, perhaps through improved customer support or product enhancements, they can increase their CLV even more, strengthening their financial position.

Conclusion

Customer Lifetime Value (CLV) is a fundamental metric for any business, particularly in the SaaS industry. It offers a deep understanding of a customer’s long-term value, aiding businesses in resource allocation and identifying cost-effective strategies to maximize returns. This insight also helps companies choose targeted marketing approaches, enhance customer engagement, and ultimately increase satisfaction and loyalty, allowing them to better meet clients’ evolving needs..

By understanding and leveraging CLV, you can ensure your Customer Acquisition Costs (CAC) remain in a healthy range, ultimately driving sustainable growth and profitability.

Ready to level up your knowledge and skills? Connect with our other sellers experts at the Tech Sales Temple FORUM, and let’s team up to boost CLV and grow each other’s businesses!